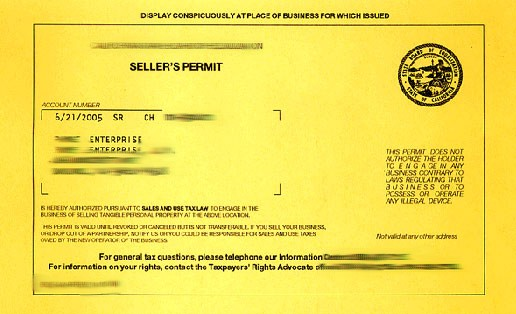

Most businesses that start selling products in California require a registered seller license. This is often called a sales and uses tax license, sales tax license, sales tax number, or sales tax registration. See the rest of this guide to determine who needs a seller license, which products are taxable, how to register for a license and reporting requirements. Think if Do I need a Seller Permit in California?

Who Needs a California Seller License?

A business must register for a seller license in California if:

- They are engaged in business and

- You intend to sell or rent a taxable tangible personal property.

- Participating in business is defined as:

The business has a sales tax relationship. A Nexus means having a physical presence in the state, such as having a physical location (such as a store or office) or using a warehouse or fulfillment center to store inventory, or having another business location.

- Have a sales representative or agent working in the state.

- Collect rent or lease payments on the property in the state

Retail goods

A California business that sells taxable products to California residents.

Out-of-state businesses sell taxable products over $500,000 to California residents.

Businesses that operate on a temporary basis (usually in one location for no more than 30 days), such as Christmas tree sales and rummage sales, must apply for a temporary CA Sellers Permit license.

What goods and services are taxable in California?

Physical product

There are some exceptions, but nearly all physical products are taxable when retailed in California. Common examples include:

- General merchandise such as furniture, appliances, and clothing.

- Articles titled or registered as vehicles

- Food and prescriptions are exempt.

In most cases, working in California is tax-free. For example, let’s say his phone screen cracks and he takes it to a phone repair shop to get it fixed. Sales tax will be added to the sale price of the new screen and any extra parts that repair the phone. Labor to replace screens is not taxed. However, companies that make furniture will indirectly collect sales tax on labor. In this case, let’s say the company is building dining tables for customers. Through labor, the wood blocks are shaped, sanded and painted to build this piece of furniture. Although labor is not directly taxed,

Digital product

Digital products are generally not taxed, with the exception of canned software (pre-made software).

Serve

Most services are not taxed in California, however, if the service is inseparable from the sale of a physical product, it is.

The information required for registration includes:

- Business Entity Type: Sole Proprietorship, Partnership, Corporation, Limited Liability Company (LLC)

- Company Number (Corporations and LLCs only)

How much does a seller license cost in California?

There is no fee for a seller license in California.

How long does it take to get a California seller license?

It may take up to 24 hours to receive the seller’s license and CDTFA account number.

Do you need to renew your California seller license?

The seller license is a one-time registration and does not require renewal. Please note that if any information about the business changes, such as a mailing address, other location, or change of ownership, these changes must be updated.

How to Get a California Resale Certificate

Businesses can purchase items for resale without paying state sales tax. The tax liability transfers from the distributor to the retailer, who then collects sales tax from the end user of the item. Wholesalers and suppliers are required to provide a sales tax ID number and a complete California Resale Certificate (also known as a Sales Tax Exemption Certificate) before they can sell to you to certify that you purchased the goods for resale.

Business tax return

How is sales tax collected?

When a business sells a taxable product or service, the business charges the customer the applicable sales tax rate. Businesses collect this tax and then submit it to the California Department of Revenue and Fees.

There are two ways to file sales tax with the California Department of Revenue and Fees. One is to apply online and the other is to apply by mail. Applications can be submitted by mail only if the business has less than $10,000 in sales tax.

How much sales tax is levied?

If the purchase is made or shipped from a business located in the state, the sales tax rate charged varies by business address. If the seller is out of state, the sales tax rate is based on the buyer’s address. In addition to state taxes, individual cities, counties, and districts may add additional sales taxes. Tax and Expense Management has a sales tax rate finder to determine how much sales tax to charge.

When are California sales tax returns due?

The submission frequency is based on expected annual sales and can be monthly, quarterly, or yearly. Typically, businesses with an average monthly sales tax liability exceeding $100 will file monthly. Frequency is reassessed annually. The deadline for submissions is the 24th of the month following the stated deadline and will be extended to the next business day unless the 24th falls on a weekend or federal holiday.