Algorithmic trading remains a relatively lesser-known trading method, despite being first introduced back in 1980. While many brokers perhaps adopt this method, investors and traders are still not soundly informed about the system. Here, in this discussion, we will know about all of the details of algorithmic methods of trading step by step.

What is an algorithmic trading method?

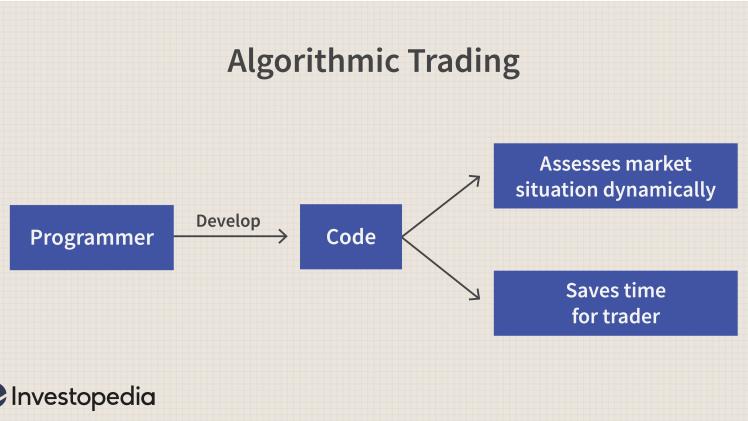

Algorithmic trading is a systematic approach of trading in the financial markets – operated through the computer software program using a defined set of instructions to place trade orders in the stock market. The limited set of instructions work based on the trade time, price, volume and other mathematical models. The method is claimed to allow the trade to make a profit at speed and frequency, which is quite impossible for a human being to do. Therefore, it is called the automated trading method, black-box trading and Algo-trading to reduce the human intervention in the trading activities.

How does the algorithmic method work?

the evaluations reported by en.meteofinanza.com, although algorithms can automatically open certain positions at specific market conditions, it is the human who programs these algorithms. One should have time, ability and temper to be in the market all day to trade through this method. Those who lack these criteria perhaps will face difficulty in terms of finding the position. Algo methods also lack the greedy entry into the market and can exit the position if it is too late.

Why do some traders prefer algorithmic trading?

Algorithmic systems provide a more systematic structure to activate the trading than other intuition-based approaches. The reasons why some traders use algorithmic trading are given below:

It allows traders to trade at the best possible price

Reduced the manual errors which occurs due to the human emotion

It has instant opportunity to place the order

Automatically set the market entry

Continuously monitor the market condition

It can better analyze the past events by available historical data

Strategies of Algorithmic method

The strategies used in algorithmic methods commonly require identified opportunities for cost reduction and earning improvement. The main techniques followed by the algorithmic methods are:

Trend following strategy

This is the most convenient and accessible strategy to implement through algorithmic trading. It does not involve any prediction, and future forecasts and trades are initiated based on the desirable trends. Trend following method is executed in moving average, channel breakout and price level movement.

Price action strategy

This strategy mainly works based on the previously opened and closed trades. It is also initiated through the maximum and minimum points on a candlestick chart. On the other hand, the technical analysis strategy uses technical indicators such as Bollinger Bands, MACD, RSI to run the operation.

Mathematical model-based strategies

This proven mathematical algorithmic model allows trading stocks in a combination of multiple options and underlying securities. Like the delta-neutral trading strategy, this strategy consists of various positions comparing the ratio of positive and negative changes in the assets and price.